When voters go to the polls to choose their state legislative representatives, they’re also indirectly determining state policy on how tax dollars are spent.

Lawmakers in Columbus weigh how much of the money collected by the state should go directly to local governments. It’s a system that’s been in place since statewide taxing began with the state sales tax during the Great Depression. It then expanded in the 1970s when the statewide income tax was implemented.

But over the past two decades, the state began reducing just how much of its collections went directly to local governments. It’s also reduced the amount of income tax it collected from the wealthiest Ohioans, cut back some corporate taxes and eliminated the estate tax.

Those cuts hit some local governments pretty hard, and many are scrambling to pay for services once covered by state tax dollars.

“We lost millions and millions of dollars,” said Mauro Cantalamessa, a Democratic county commissioner in Trumbull County who took office in 2014, around the time the effects of the reductions in revenue sharing were phased in.

He said though the state did provide some relief in replacement payments, the reductions were tough.

“It was a shot in the arm to a lot of local governments that didn't have to go to their constituents and their voters and say, ‘Look, we need, we need X amount of dollars,’ because, you know, we can't, we can't afford to keep the jail open, or we can't afford to, you know, run the courts or whatever it may be these essential services that we have to provide,” Cantalamessa said.

Zach Schiller from Policy Matters Ohio said the share of state taxes that go to local governments is half of what it once was.

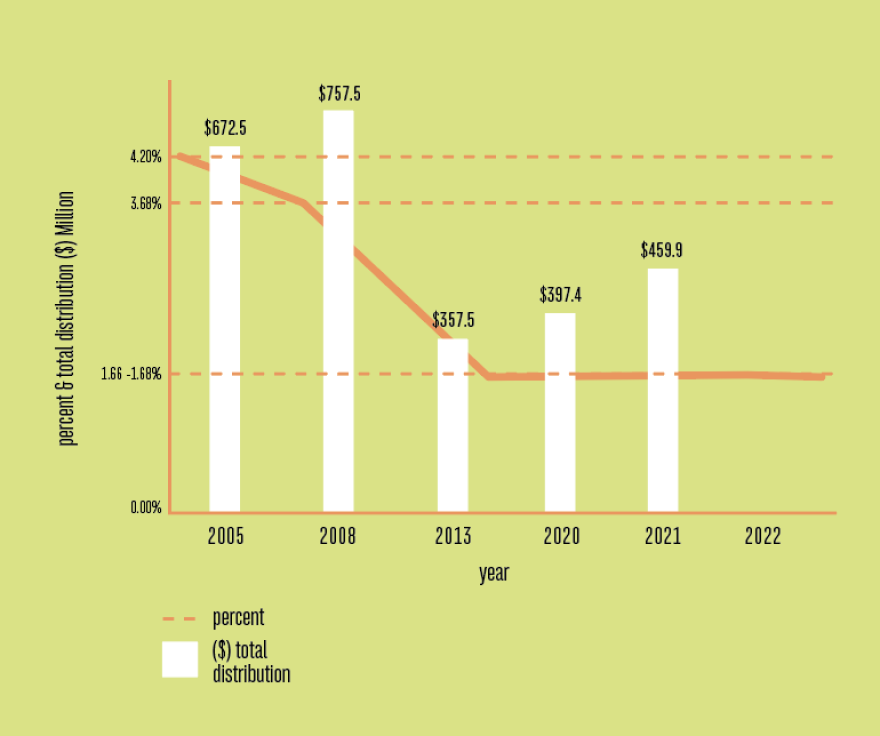

The state went from sharing 4.2% of revenue through the local government fund in 2005 to 1.66% now.

The state income tax was cut nearly in half over the last 17 years — collections went down about $7 billion a year — and other taxes were reduced, eliminated or redirected to state coffers instead of local governments.

“The net of it is that local governments across Ohio are losing a billion dollars a year in revenue that they once received,” Schiller said.

The percentage of revenue sharing should be put back to 3.68%, the percent shared in 2008, said Jon Honeck, senior policy analyst for the County Commissioners Association of Ohio.

Honeck said new tax collections from internet sales in 2019 did help counties weather the cuts, but much of Ohio’s economy is turning toward the service industry.

And, “by and large, most of the service sector economy is outside of the sales tax,” he said.

Heidi Fought, executive director of the Ohio Township Association, said townships are only getting “scraps” of money through the fund. With most other sources of revenue earmarked to specific uses, that can leave townships lacking, she said.

“That's money that that those entities can use for all general services. It's not earmarked for very specific things like road funding, or fire or police” she said. “It's providing general services, you know, if they need to, you know, fix a broken bathroom or baseball diamonds. They just don't have that more flexible revenue anymore, like they used to, and, and that's all due to, you know, the state, you know, basically reneging on their, their sharing of, of funds with local governments.”

And the policies fly in the face of the local governments that supported the creation of the taxes, she said.

“The state wouldn't be collecting those taxes without the help of the local governments trying to get it passed way back in the 1930s,” Fought said. “That local government fund was supposed to be revenue sharing between the state and counties, townships and municipalities, that revenue sharing was supposed to be based on the growth that Ohio would see in taxes.”

The changes forced some communities and schools to increase local taxes in response, shifting the burden and adding new sales taxes, property levies and local income taxes. Schiller said that creates disparities between the services available from county to county and can leave some communities, and the state as a whole, behind.

“We have a lot of services more dependent on local taxation and local resources than many other states. So, you find that when you look at a whole variety of services that Ohio has much less state support than other states do. And that's true with everything from public transit to children's services,” Schiller said.

These policies typically benefit businesses and high earners, people making more than $500,000 a year. By reducing a progressive tax like the income tax, it forced the state to shift its reliance to more regressive taxes like cash collected from sales. That hits lower-income people harder than income taxes do, because income taxes are tied to earnings.

“We have reduced the taxes that are the most progressive and thereby our tax system falls more heavily on those who make less - low income and lower middle income people, or you know, low income people. People in the bottom 20% of the income distribution are paying almost twice as much as people in the top 1% and make more than half a million dollars a year on average,” Schiller said.

Greg Lawson with the conservative Buckeye Institute said lower taxes in the state could work, but only with the right “mosaic” of other policies.

Right now, the state is underperforming compared to other states, but part of that is connected to the change in industry in the state.

But, Lawson said, taxing at all of these different levels creates a less-predictable patchwork of local taxes for citizens and business.

“And so what you end up with is a that layering effect, or even better as an analogy is the frog in the pot of water where the temperature keeps going up. And the frog never really realizes that it's getting boiled until all of a sudden it's boiled,” Lawson said.

If lawmakers want to give people certainty, he said, they should strive to create the right mix of taxation to make it more predictable. They also should stop whittling away the tax base with new tax loopholes and tax breaks, Lawson added.

A multitude of tax breaks force the people or businesses that are paying to pay more, he said.

“When you give somebody a tax break, what you're essentially saying is my tax system sucks. It's expensive, and it's difficult. So I'm gonna give you a special dispensation, a special break,” Lawson said.

Honeck agrees.

“We always feel that the best sales tax is as broad as possible. And that enables the rates, the rates to stay low, because of your broad base,” he said.

Voters should watch lawmakers closely when it comes to the choices they are making for revenue distribution and collections, Honeck said.

“Lawmakers should be asked by voters, ‘Are you going to support county government? What's, what's your view about supporting indigent defense, helping counties out with their jail expenses? Will you support our county engineers who are responsible for the upkeep and repair of hundreds of miles of county roads, particularly in some of the rural counties,’” Honeck said.

Kent State University Professor Wendy Patton said it’s important to take a close look at candidates racing to make these decisions.

It may not be as eye-catching as looking into a candidate’s Twitter account, but voters should look for candidates who share their values about how tax revenue should be shared with local governments, how essential services should be funded and which way they think the tax burden should be shouldered.

“In deciding how we prioritize our use of all these different streams of funds, it shows our values, it shows our legislators’ values, and it's up to the voters, to the citizens to keep a close eye on this… That's why we need to do our job and be thoughtful and careful about understanding who they are, what they're voting for, and what we want,” Patton said.

Copyright 2022 WKSU. To see more, visit WKSU.