The 2017 Republican tax law changes are in full effect this year, and the average federal tax refund is down nearly 9 percent from a year ago. The law lowers federal withholding paychecks and increases the standard deduction for individuals, but it also takes away some deductions. And if taxpayers haven’t adjusted their withholding, they might find themselves with smaller refunds or even owing money this year. What do Ohio's senators think about this?

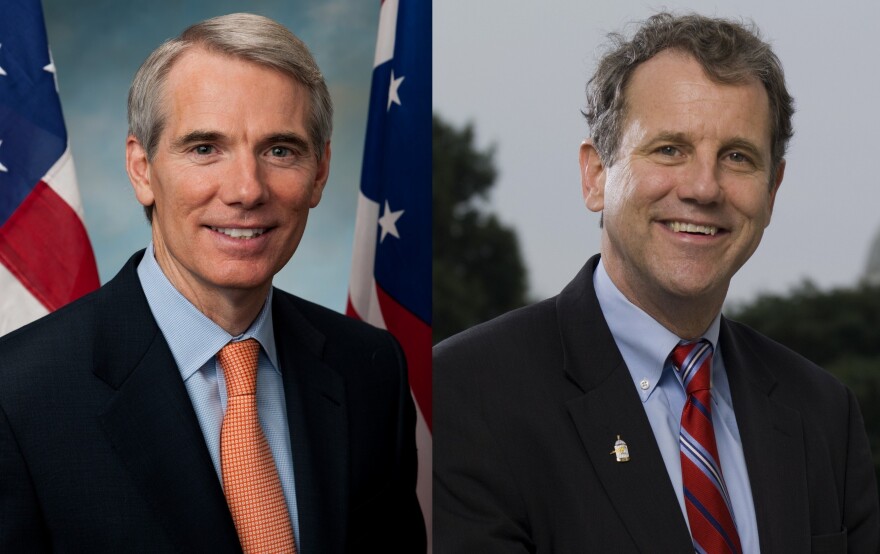

Democratic US Senator Sherrod Brown, who voted against the GOP tax reform plan, says it gives huge tax breaks to top wage earners but does nothing to help middle income Ohioans.

“We need to throw out President Trump’s tax law – just completely throw it out and rewrite our tax code to put people first. We know what this last tax law did – 70% of the benefits went to the wealthiest one percent," Brown says.

Brown says the law should have rewarded corporations that make products in the U.S. and penalized those that don’t pay a living wage. Republican Sen. Rob Portman wasn’t available for an interview, but recently told Bloomberg he also thinks some tax reform is necessary to deal with the nation’s rising debt.

“We do need to put together a package to ensure that we can get this fiscal situation under control so that it doesn’t have a terribly detrimental impact on the economy which is possible if we don’t deal with it," Portman says.

Portman voted for the current tax reform plan.

Copyright 2019 The Statehouse News Bureau